ARLINGTON, Va. – The Navy is spending money on shipbuilding, but the industrial base is feeling pressure to upgrade its equipment and invest in training workers to land lucrative contracts.

A panel of industry executives representing both the largest Navy shipbuilders and smaller suppliers all detailed during the annual Naval Submarine League symposium some of the investments their making in their yards and plants to keep their capabilities, efficiencies, and costs competitive for contracts.

Steam compressor and valve maker Curtiss-Wright, for example, invested roughly $50 million in building and retooling facilities during the past four years, Todd Schurra, the general manager of Curtiss-Wright said. The investments were all geared toward reducing production time and costs.

“The focus was to reduce the cycle time of deliveries by a magnitude of several months,” Schurra said.

W International, which fabricates large engineered structures such as the various tanks installed on submarines and aircraft carriers, is in the processes of opening a new $60 million manufacturing facility just outside Charleston, S.C., said Edward Walker, the chief executive of the Detroit-based company.

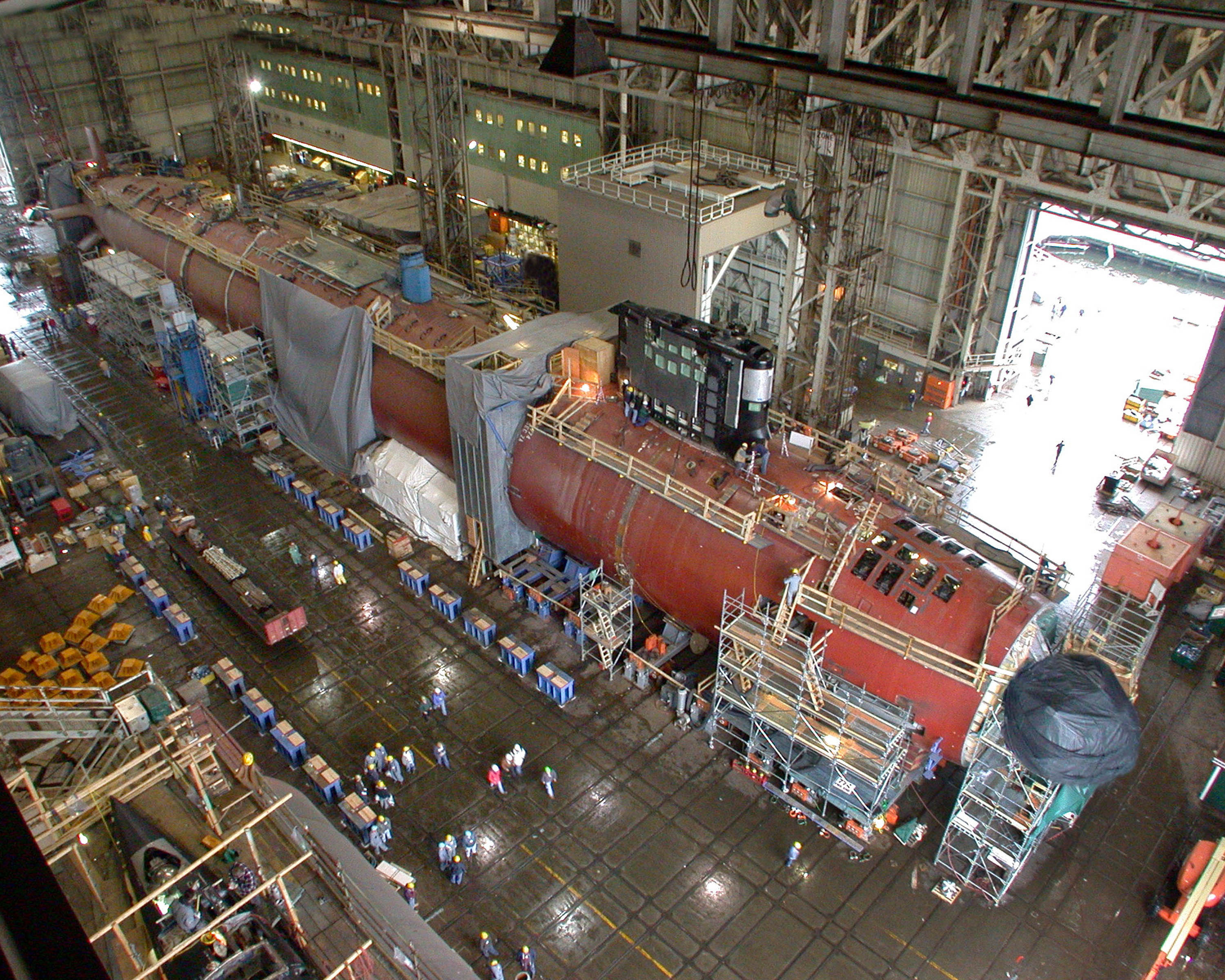

By investing now, Walker said the company would be prepared to meet increased demand for its products as the Columbia-class ballistic missile submarine production ramps up, and the Navy quickens the pace of the Gerald Ford-class aircraft carrier shipbuilding. The new site is located on the water and can accommodate deep-water barges, vital for the company’s expansion strategy because many of its products are too large to ship by rail or truck.

“We have LOI’s (letters of intent) with Newport News Shipbuilding and Huntington Ingalls Industries. We have a 5-year plan to go up to 1,000 employees,” Walker told USNI News following the panel. “There’s 30 years of work.”

However, Pentagon leaders worry too many smaller suppliers are not in a financial position to make the kinds of investments Schurra and Walker discussed. A month ago, the Department of Defense issued a report assessing the defense manufacturing base.

Among the Pentagon’s findings, the defense industrial base lost about 20,500 U.S.-based manufacturers during the past 18 years. All military branches are affected, but shipbuilding especially was cited by the report as being in a critical state. In some cases, the Navy only has one or two suppliers left to make essential ship propulsion components like shafts.

“These companies struggle to survive and lack the resources needed to invest in innovative technology,” the report says. “Expanding the number of companies involved in Navy shipbuilding is important to maintaining a healthy industrial base that can fulfill the 355-ship fleet and support the Navy’s long-range shipbuilding plan.”

While General Dynamics Electric Boat is a Navy supplier, the company is the prime contractor for the Columbia-class program and feels relies heavily on smaller companies to produce parts. Ensuring these hundreds of suppliers have enough work to justify reinvesting in their facilities, along with retaining and training employees, is critical to keeping programs on schedule and within Congressional budget constraints, said Jeffrey Geiger, the president of Electric Boat.

“We’re very fortunate this year, in the Fiscal Year ’19 budget,” Geiger said. “Congress appropriated an additional $225 million specifically for supplier development.”

Electric Boat used the money to fund pre-qualification efforts with suppliers, where Electric Boat helps companies meet manufacturing standards, such as welding, well before announcing contract competitions. Doing this, Geiger said, helps suppliers improve their positions when it is time to compete for sub-contracts.

Electric Boat is also encouraging suppliers to reinvest in their facilities by issuing letters of intent, as was the case with W International. Electric Boat is also configuring contracts to encourage investment in manufacturing processes.

“We’ve offered improved financial terms on contracts that encourage capital investments,” Geiger said. “We can do some things on the terms and cash flow on these contracts that make it favorable for suppliers to invest in their facilities.”