This post has been updated to include additional information from the Navy.

WASHINGTON, D.C. — The Navy needs potentially as much as $150 billion over current budget plans to “jump-start” shipbuilding and get on a trajectory for a 355-ship fleet, the vice chief of naval operations said on Wednesday.

The money would add about 30 ships to the fleet beyond current plans, Adm. Bill Moran said.

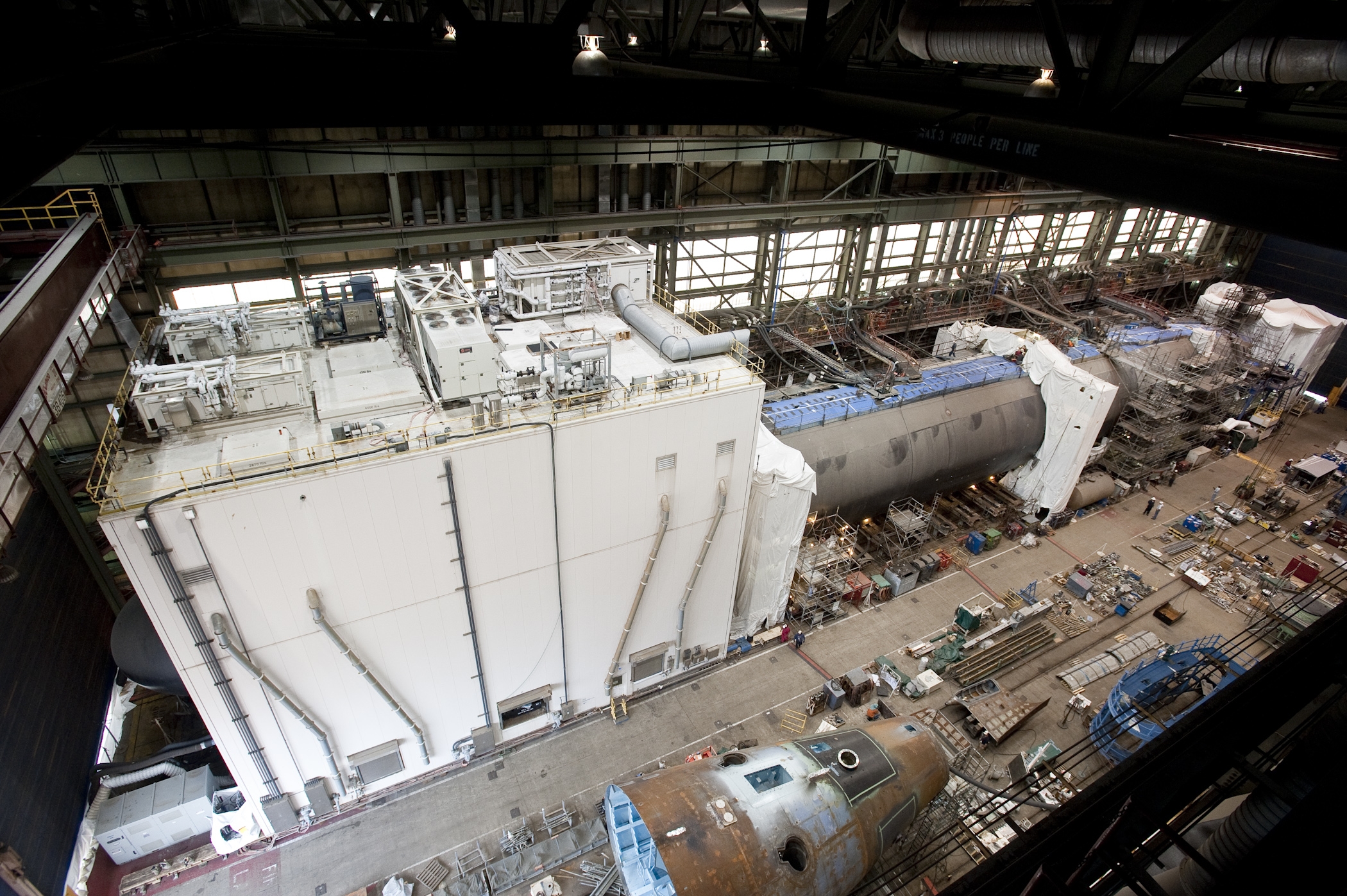

The exact size of the future fleet doesn’t matter right now, but rather the Navy just needs to start boosting its investment in shipbuilding quickly – which means buying many more Virginia-class attack submarines, Arleigh Burke-class destroyers and Ford-class aircraft carriers in the next few years, he said.

“I’m not here to argue that 355 or 350 is the right number. I’m here to argue that we need to get on that trajectory as fast as we can. And as time goes on you start to figure out whether that number is still valid – 10 years from now, 20 years from now 355 may not be the number,” Moran said today at the annual McAleese/Credit Suisse “Defense Programs” event.

“Our number, give or take, to get to 355, or just to get started in the first seven years, is $150 billion. That’s a lot of money.”

Moran told USNI News following his remarks that dollar figure wasn’t exact but was based on the Navy’s best guess for how much it would cost to immediately begin a fleet buildup. A Navy official told USNI News later that one internal Navy estimate put the cost at about $80 billion over the seven years, whereas a Congressional Research Service estimate was closer to $150 billion.

“When you look at the number that started our 355 trajectory, to jump-start it – in order to jump-start it we think we need to build an additional 29 or 30 ships in the first seven years,” he said.

“When you do all that math, it’s a lot of money that we don’t have. But we were asked to deliver on that, so we’ve passed along what we think it would take. And obviously, any number you give in this environment is going to be sticker shock. So that’s why I say don’t take me literally, all it is is a math equation right now.”

Those 30 ships would mostly come from three ship classes in serial production today.

“We definitely wanted to go after SSNs, DDGs and carriers, to get carriers from a five-year center to a four-year center and even looked at a three-year option. So the numbers I will give to you are reflective of those three priorities, because those are the big impacters in any competition at sea,” he told USNI News.

“Amphibs come later, but I’m talking about initial, what are we building that we can stamp out that are good. We know how to build Virginia-class, we know how to build DDGs.”

Many in the Navy and industry had believed amphibious ships – particularly the San Antonio-class amphibious transport dock (LPD-17) or the upcoming LX(R) derivative of the LPD design – would be part of the initial ship buildup. Moran, though, said the Navy’s recently drafted plan to get on the 355-ship trajectory “feathered in LX(R)” in later years.

Moran said during his presentation that the Navy is currently on track to hit 310 ships – if the Fiscal Year 2017 spending bill is passed by Congress this spring after an extended continuing resolution, the Navy would finish buying the last ships that will eventually push it to 310. Without this quick ramp-up of shipbuilding, though, the Navy won’t just fail to reach 355 ships but will actually slip back below 300 ships, he said. Dozens of ships built during the Reagan-era buildup are headed for decommissioning in the 2020s and the Navy needs to act quickly to either replace them at pace and stay around 310, or ramp up even faster to grow the fleet.

The vice chief told reporters that the plan for a 355-trajectory includes building more destroyers, building carriers faster, and maintaining two SSNs a year even as the new Columbia-class ballistic missile submarine begins production. A Columbia-class SSBN is the equivalent of about two SSNs, meaning the submarine industrial base would see about double the workload in any given year under this plan.