The Navy has confirmed that its submarine industrial base can continue building two Virginia-class attack submarines a year even while adding the Columbia-class ballistic-missile submarine to its workload, giving a key congressman confidence in the House’s plan to boost submarine procurement in the coming years.

In fact, according to a Navy report requested by lawmakers in the 2017 defense authorization bill, continuing to build two SSNs a year is not only “viable” but would “have a positive effect on the overall submarine industrial base cost and workload profiles” and “would provide benefit to Navy’s stack submarine force inventory.”

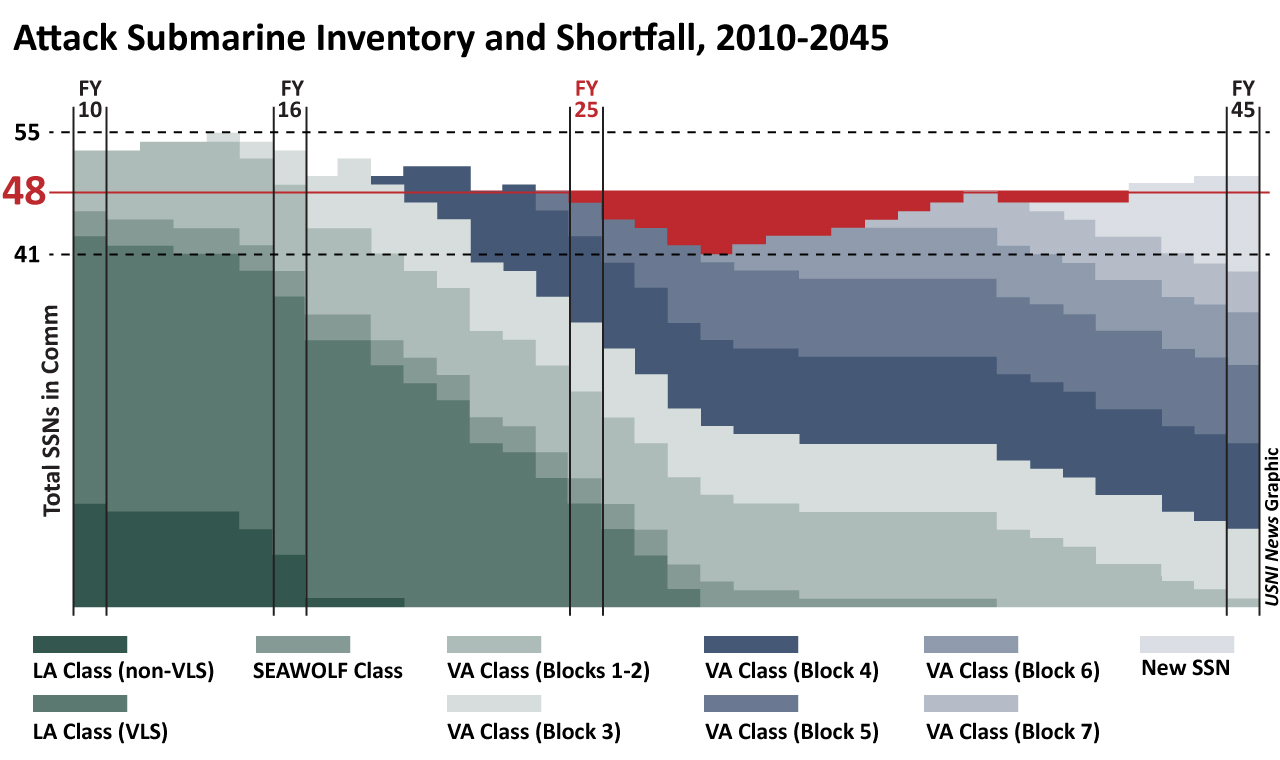

The Navy had previously planned to build just two subs a year for the foreseeable future – either two attack subs or one SSN and one SSBN. Based on the Columbia-class construction schedule, that would leave seven years between now and 2030 when the Navy only bought one attack sub a year, exacerbating an attack submarine shortfall the service is already facing.

While lawmakers have for a few years discussed not only maintaining the two-a-year rate for SSN construction but even bumping up to three or four in years when a SSBN isn’t procured, the Navy was a little slower to make any commitments. The service just this spring announced it was adding a second SSN to its Fiscal Year 2021 plans, the year it buys the first SSBN, and that it would consider purchasing three SSNs a year in the future.

Rep. Joe Courtney (D-Conn.), the ranking member on the House Armed Services seapower and projection forces subcommittee, told USNI News today that the report amounted to “a very resounding affirmative from the Navy” on the industrial base capability, which was important because “they really were concerned that the bandwidth of submarine [industry capability] wasn’t wide enough to handle that amount of work, and for the Navy to come back with a very strong report saying, yep, we don’t have to reduce Virginia class in the Columbia class years, to me that needle really moved in terms of the Navy’s confidence, public confidence, in having all these concurrent efforts stay on track and perform.”

Courtney said the timing of this affirmation is important, since Navy negotiations with submarine builders General Dynamics Electric Boat and Newport News Shipbuilding for the Block V contract will begin next year, just ahead of the start of Columbia-class construction in 2021 and the introduction of the Virginia Payload Module in 2019. The House Armed Services Committee in its FY 2018 National Defense Authorization Act, which was passed by the full House of Representatives on July 14, authorized the Navy to buy 13 subs over five years in that block buy instead of 10 – two in 2021 and 2024, when the first two SSBNs are bought, and three a year in the other three years of the contract. Courtney said this report validates the “robust” spending plan HASC advocated in its bill and confirms that the industrial base is “starting to flex its muscles” ahead of the workload increase.

The report notes that limiting factors to increased SSN production are the shipbuilders’ workforce, shipyard facilities and supply base. Importantly, the report adds that maintaining two SSNs a year, which will result in seven additional boats being bought between now and 2030, “will be a challenge to the submarine industrial base that can be solved only if the shipyards are given sufficient time to adjust facility plans, develop their workforce, and expand the vendor base.”

Asked about that line, Courtney told USNI News that the 2018 defense bill’s push to buy three submarines a year sends a message to the shipbuilders that they should start addressing those three issues now.

“Spending money on equipment, hiring, this is a safe bet because Congress and the Navy are really in this for the long haul,” he said.

“In the wake of the Cold War downturn in terms of submarine construction, there really has been a hangover for some of these companies who were not able to absorb the downturn as well as the large shipyards were – in fact some of them went out of business – so I think there’s an inherent virtue in the NDAA language that I think will send a really strong message of confidence, particularly to the folks who are at the second and third tiers of submarine production.”

He added concern, though, that while the HASC has done its part to support this boost in submarine construction, support from outside the HASC and the Navy will be needed as these two prime shipbuilders ramp up their capacity. He pointed to the Department of Labor’s apprenticeship grant program, which in 2017 was funded at $95 million but in the 2018 House Appropriations labor subcommittee bill was cut completely. Courtney said there was already talk among some lawmakers to push back against this cut to the apprenticeship program, which has already been important to Electric Boat as it increases the size of its workforce.

“There’s a skills gap: the jobs are there, the skills aren’t, and there’s just no question that in terms of filling that gap it’s programs like DOL’s apprenticeship grant that solve that problem,” Courtney said.

“National defense and shipbuilding is really an all-of-government effort,” and he called upon other committees to make the right investments to support industry as well.

The Navy’s commitments to change its plans moving forward in light of this report were tepid, though it strongly and repeatedly outlined the benefits to maintaining this two-a-year SSN construction pace.

Despite saying that “maintaining a steady [Virginia Class Submarine] procurement cadence would result in added labor and economic order quantity (EOQ) efficiencies, optimization of production facilities, and elimination of costly production surges and gaps, reducing VCS costs across the respective block buys,” the service didn’t actually follow through with a promise to do so, instead saying only that it would analyze the cost of maintaining a two-a-year production rate.

Courtney, on the other hand, said Congress is pushing hard to buy as many SSNs as the industrial base can support, given that the Navy was already facing the prospect of a seven-sub shortfall compared to its previous requirement to have 48 submarines – a shortfall that was drastically deepened when the Navy announced earlier this year in a new Force Structure Assessment that it needed 66 submarines to meet its global commitments.

By providing advance procurement and economic order quantity funding in the 2018 defense bill ahead of the Block V contract being negotiated, “we’re really – in a very specific and well thought out way – demonstrating that we’re going to shorten that bathtub as quickly as humanly possible,” Courtney said of the shortfall.

“Certainly Congress is pushing as hard as we can, now at least, to shorten that length of time where the fleet is not going to meet what the Force Structure Assessment now says is required.”