The Navy released its first-ever long-range ship maintenance and modernization plan amid a growing fleet and a growing backlog of repair work, and the report highlights challenges in dealing with chronic mismatches between maintenance requirements and yards’ capacity.

The report, Report to Congress on the Long-Range Plan for Maintenance and Modernization of Naval Vessels for Fiscal Year 2020, highlights a shortage of dry docks for surface ship maintenance and the need to improve existing infrastructure at public and private yards to keep up with newer classes of ships, as well as the need for process improvements to allow private shipyards and the supply chain to grow their capacity and move faster to respond to a growing fleet size.

“Sustaining the 355-ship fleet will require changes to both public and private industrial capability and capacity. Current infrastructure will require update and refurbishment to support modern classes of ships and repair. Likewise, additional dry docks will be needed to address the growing fleet size. Navy and industry partners must create work environments where talented Americans will want to work and contribute to the national defense. This includes investments in updating facilities and capital equipment, and as well as providing that workforce training that is both modern and relevant and compensation commensurate with the skill required to repair Navy ships,” reads the report.

“Finally, we must avoid feast and famine cycles that erode both the repair industrial base and the underlying vendor supply base. Consistent funding matched to steady demand for work will enable the repair base, public and private, to grow to meet the needs of the 355-ship Navy.”

Assistant Secretary of the Navy for Research, Development and Acquisition James Geurts announced the creation of this 30-year ship maintenance plan last summer, telling reporters that “we build a 30-year shipbuilding plan, that’s only as good as our ability to continue to repair and modernize those ships once we build them. So what we’d like to do is build a companion plan that then takes the 30-year shipbuilding plan, both what we have in inventory and what we build in that 30-year [shipbuilding] plan, and then forecast and plan for all the repairs and modernizations we’ll have to do.”

Navy spokesman Capt. Danny Hernandez told USNI News today that the report “is part of a strategic look at how we maintain and modernize ships. The report identifies key enablers such as industrial base capability and capacity, shipyard level loading, and workforce and facility investments to meet requirements of the long-range shipbuilding plan.”

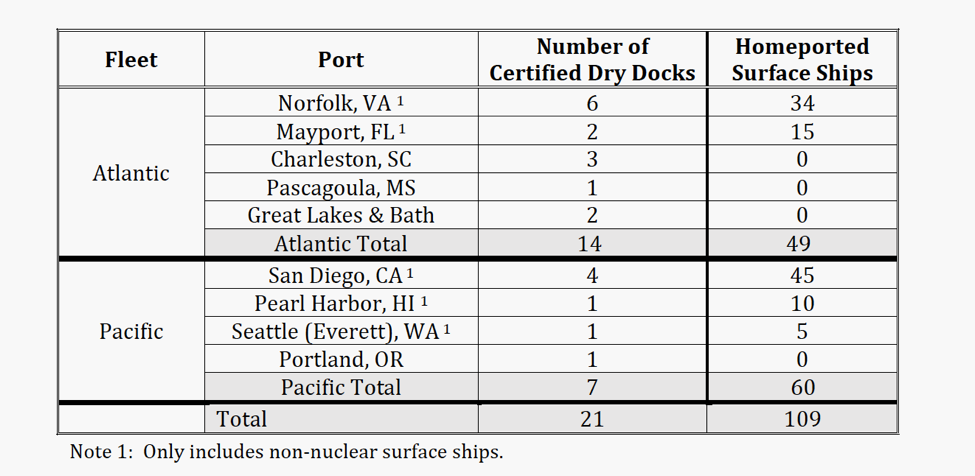

On capacity, the Navy has talked about the need for more certified dry docks to conduct maintenance for surface ships, but the service has struggled to entice either existing Navy contractors to build new dry docks or commercial shipyards to agree to do business with the Navy. The report makes clear just how bad that need is: for 109 surface ships that are homeported in the United States, only 21 dry docks exist to conduct routine maintenance. The situation is even worse on the West Coast, where only four dry docks service the 45 surface ships – including Independence-variant Littoral Combat Ships, which require dry docks more frequently than other classes of ships due to the trimaran hull design.

“The ratio of ships to dry docks present in the Pacific presents a significant challenge that reduces margin for schedule changes and growth. The Navy has conducted a market survey of available/potential dry docks and is developing a long-range plan to increase the number of certified dry docks in the Pacific (and elsewhere if required) to reduce this shortfall,” reads the report.

On the public yard side, the Navy’s four naval shipyards have a combined 18 dry docks to tend to all aircraft carriers and submarines.

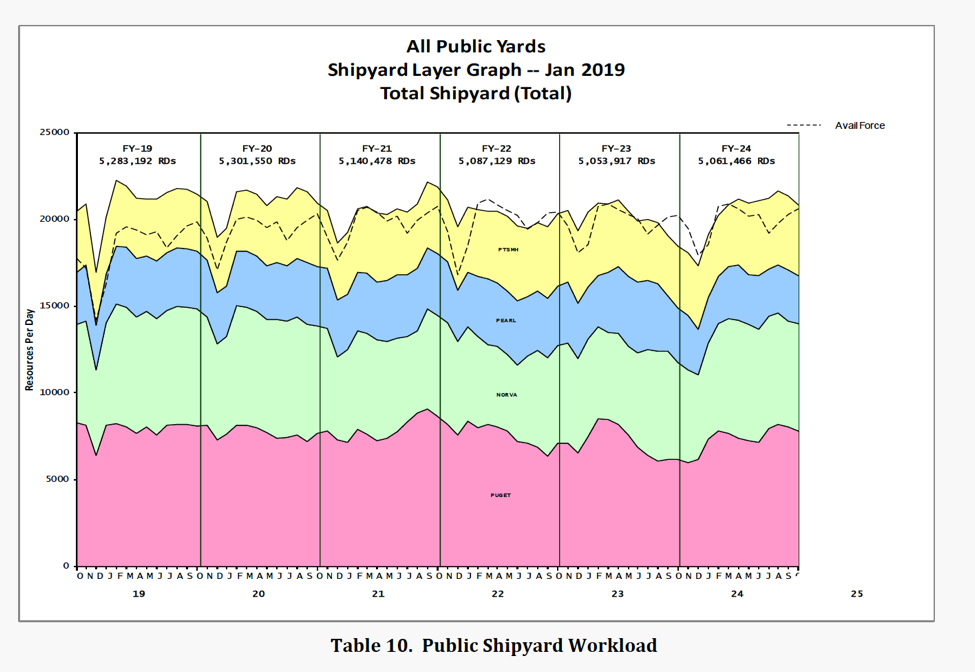

While capacity is clearly an issue for the Navy, the service will also struggle with the timing of its maintenance availabilities. Backlogs have built up in recent years due to ships coming in for maintenance, workers finding additional problems beyond the scope of the work package, and delays building up – which have a domino effect on the ships waiting to come into the yard next. Navy officials have long said they aim for better planning, where work packages are accurate and workload can be matched to workforce capacity ahead of time.

Though gains had been made in reducing that backlog, as currently laid out in the plan, the Navy is chronically overbooked at its four public yards, at times thousands of people short of the workforce that would be required to conduct maintenance on the subs and carriers that will be at the four yards on any given day.

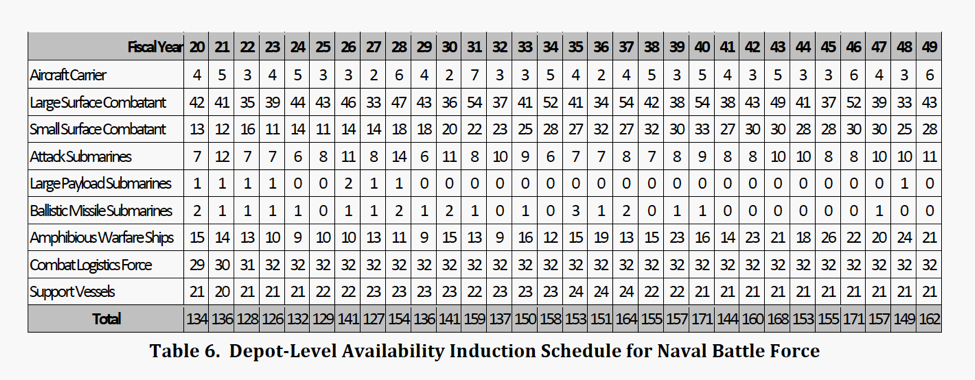

Looking forward, with the number of submarine depot-level maintenance availabilities per year oscillating from 14 to six at one point, planning will continue to be a challenge.

While upfront planning and workload management will be important for the Navy as the fleet continues to grow, so too will be finishing the maintenance availabilities on time and on budget.

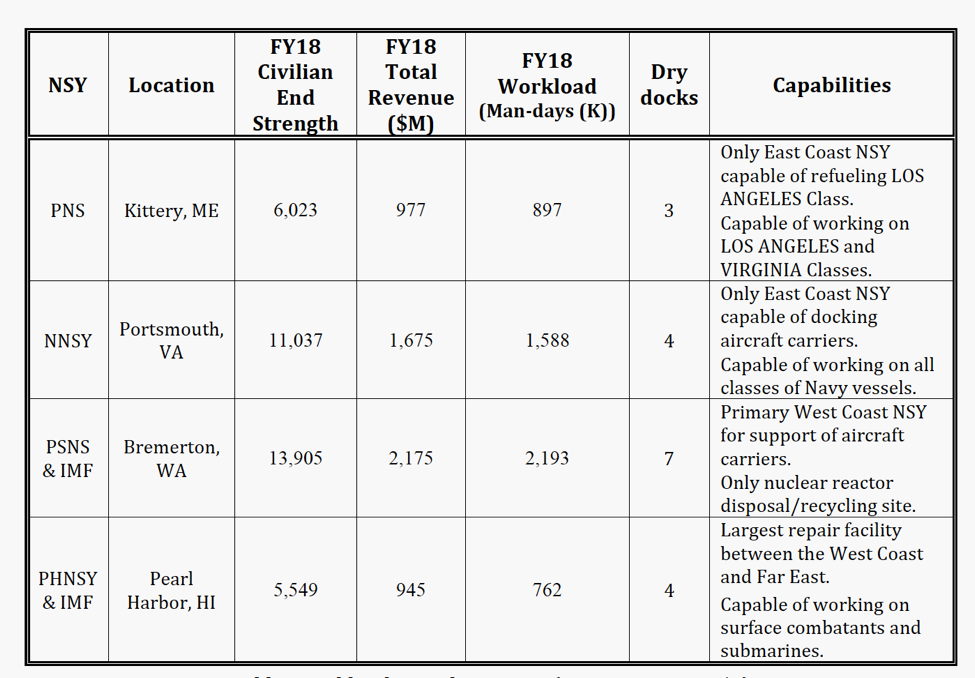

To that end, the Navy has embarked on several initiatives. The Shipyard Infrastructure Optimization Plan – a 20-year, $21-billion plan pitched to lawmakers last year – would look at optimizing the layout of the four naval shipyards, modernizing aging capital equipment and improving old dry docks.

“In 2018, most naval shipyard capital equipment was assessed as beyond effective service life, obsolete, unsupported by original equipment manufacturers, and at operational risk. This aged equipment increases submarine and aircraft carrier depot maintenance costs, schedules and reduced NSY capacity. Modernizing naval shipyard capital equipment is therefore essential to meeting future capacity and capability requirements, and maximizing fleet readiness,” reads the report.

Additionally, engineering analysis to support optimized layouts at the four yards “will restore badly outdated facilities while simultaneously reducing total personnel and material travel and movement by an average of 65 percent, which equates to recovering 328K man-days per year.”

On the private yard side, “the Navy, in conjunction with the ship repair industry, is developing Private Shipyard Optimization (PSO) initiatives for optimal placement of facilities and major equipment in each region. This includes an investment plan for infrastructure needed to support availability maintenance in support of a 355-ship Navy. The PSO results are expected in time to support the FY 2021 budget request. Working closely with private shipyards, the Navy is also implementing a Private Sector Improvement (PSI) program that addresses workload stability, governance, contracting and process optimization. The goal of the PSO and PSI initiatives is to identify and eliminate barriers to private sector ship availability throughput to affordably achieve on time delivery of surface ships.”

“The PSO/PSI initiatives will address appropriate risk sharing, timely repair availability completion, and streamlined business processes at private shipyards and the supporting vendor base,” the report adds. For example, it notes, a leading cause of delays at these private shipyards is unexpected work growth, the approval process for which can halt a maintenance availability while the request goes high up the chain of command. The report notes that 70 percent of growth work consists for small-value items, and so raising the dollar amount at which lower-level managers could approve the changes would “significantly reduce cycle time for approval” and allow maintenance availabilities to continue with fewer interruptions.

The report makes clear the Navy needs industry to invest in greater repair capacity, both at the private shipyards and at the vendors that make materials and components to support maintenance and modernization. But for industry to invest, the Navy also owes industry some predictability in funding and in workload forecasts, the report acknowledges.

“Maintenance and modernization requirements must be fully funded and efficiently executed to reduce deferred maintenance that adds risk to future fleet readiness. Risks to be addressed during the next 30 years include optimizing maintenance and modernization business processes (e.g., availability planning and execution) and adjusting the industrial base capacity and capability as the fleet grows to 355 ships,” it reads.

“Finally, the Navy must stabilize the vendor base by forecasting future logistics requirements (material availability) required to maintain fleet reliability and reduce the risk to readiness.”